Service-related disabilities can make it hard for a veteran to keep steady work. Through VA Form 21-8940, they may be able to apply for more benefits. This is based on their individual unemployability (IU).

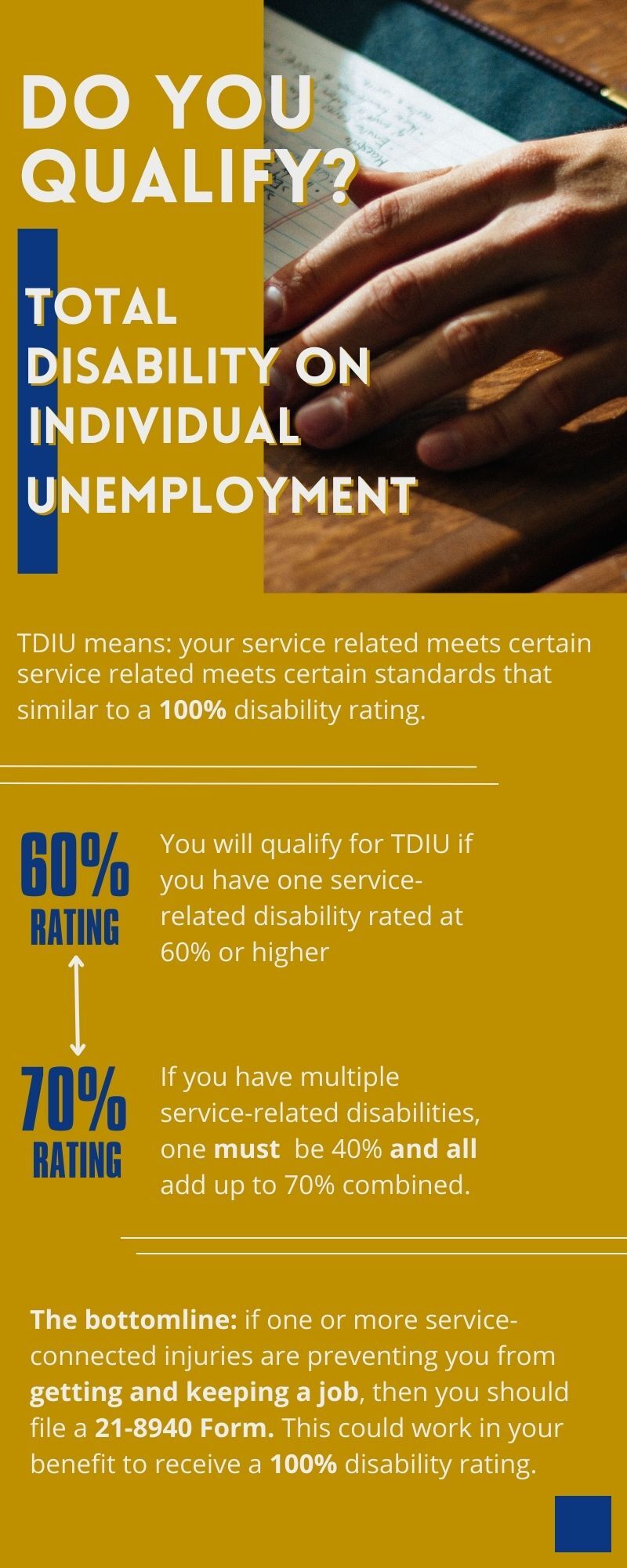

IU is a part of the VA disability compensation program. If qualified, one may be able to access higher disability benefits. At the same level as a veteran that has a 100% disability rating.

How Total Disability Based On Individual Unemployability (TDIU) Works?

To be eligible, one must meet certain disability standards. This is as per the VA individual unemployability fact sheet.

If you have one service-related disability, it must be rated at 60% or higher disabling.

If you have many service-related disabilities, one must be rated at least 40% or higher disabling. The combined total disability on IU should add up to at least 70% or higher disabling.

TDIU refers to these disability ratings. And their limits in establishing a need to increase benefits to 100%.

These disabilities should be the reason you cannot hold down a steady job. If in marginal employment (odd jobs), you may still qualify for IU benefits. VA income limits that place you below the federal poverty threshold can grant you IU benefits.

Who Qualifies for TDIU?

This program caters to just veterans with service-related disabilities. They must have reached a point where it is impossible to get steady work.

To be eligible, they must meet the threshold of at least 60% or more disabling on single disabilities. Or a combined total rating of 70% disabling or more on multiple disabilities. With at least one disability rating 40% or higher.

Why Do I Need VA Form 21-8940?

VA Form 21-8940 is titled “Veterans Application for Increased Compensation Based on Unemployability”.

It allows veterans to file a claim for a boost to their disability benefits. As they complete the form, they must give evidence.

It should prove that their disability makes it futile for them to hold down a steady job. It is the main document required by the VA to consider making such changes.

The Five Parts of VA Form 21-8940

Veteran Identification

This first section of the application must be completed to verify your identity. You must provide full names, social security number, date of birth, and VA file number. You will also need to provide your current contact information. This will include a current detailed address, email address, and telephone number.

Disability and Medical Treatment

Here you will have to provide medical info related to your disabilities. This includes the nature of the disability. And when it was last treated in the past year.

You will provide details on the doctors you have had treatments from. The names of their hospitals and dates of any hospitalization.

The space to fill out this data is limited. If you have more info to give than the space allows, you can still include it. Do this under Item 26-Remarks, which is at the end of Section IV.

Employment Information

This section will provide details on your work history. Under parts 14-17C you will have to provide data including:

- Date the disability affected full-time employment

- Date you last worked full-time

- Date you became disabled enough not to work

- The most you have earned in a year, which occupation, and which year

Part 18 provides space to detail what you have been doing the past five years. Here you will indicate your employment, any active and inactive duty.

You will provide info on employers, dates, and hours worked. Also, the nature of the work, earnings, and any time taken off due to illness.

Parts 19-21 will query on your disability and if you receive or are expecting any benefits.

Parts 22-22C relate to any attempts to secure jobs since becoming disabled enough not to work. If you have managed to get work, you should provide details.

This will include the name of and addresses of these employers. Also, the nature of work and dates worked.

Schooling and Other Training

This section relates to academic history. You will have to input details on any schooling from grade school onwards. Part 24A-24C is where you will indicate the type of training received before you became disabled enough not to work.

Part 24A-25C queries any education or training after you became disabled enough not to work. Do include the start and end dates for these trainings.

Where and How to Send the Form

This section details where to send in your application. There are several options. The first is to send it in via certified mail to the address below.

Department of Veteran Affairs

Evidence Intake Center

PO Box 4444

Janesville, WI 53547-4444

The second option is to fax it to either of the numbers below:

Toll-Free: 844-531-7818

Local: 248-524-4260

You can also seek help in completing this form at your local VA regional office. They can also help with sending it in.

Be Patient with the Process

This process can take a while to be completed. Anywhere between a few months to years.

Time is also needed to review and verify supporting documents. You may also be sent a letter from the VA requesting additional information.

Do be patient as your form is processed. If approved, the benefits will be applied retroactively. This means the amount will be backdated to when you initially applied.

If your claim is denied, you have just one year to make an appeal. Thereafter, the decision is made final.